nh prepared food tax

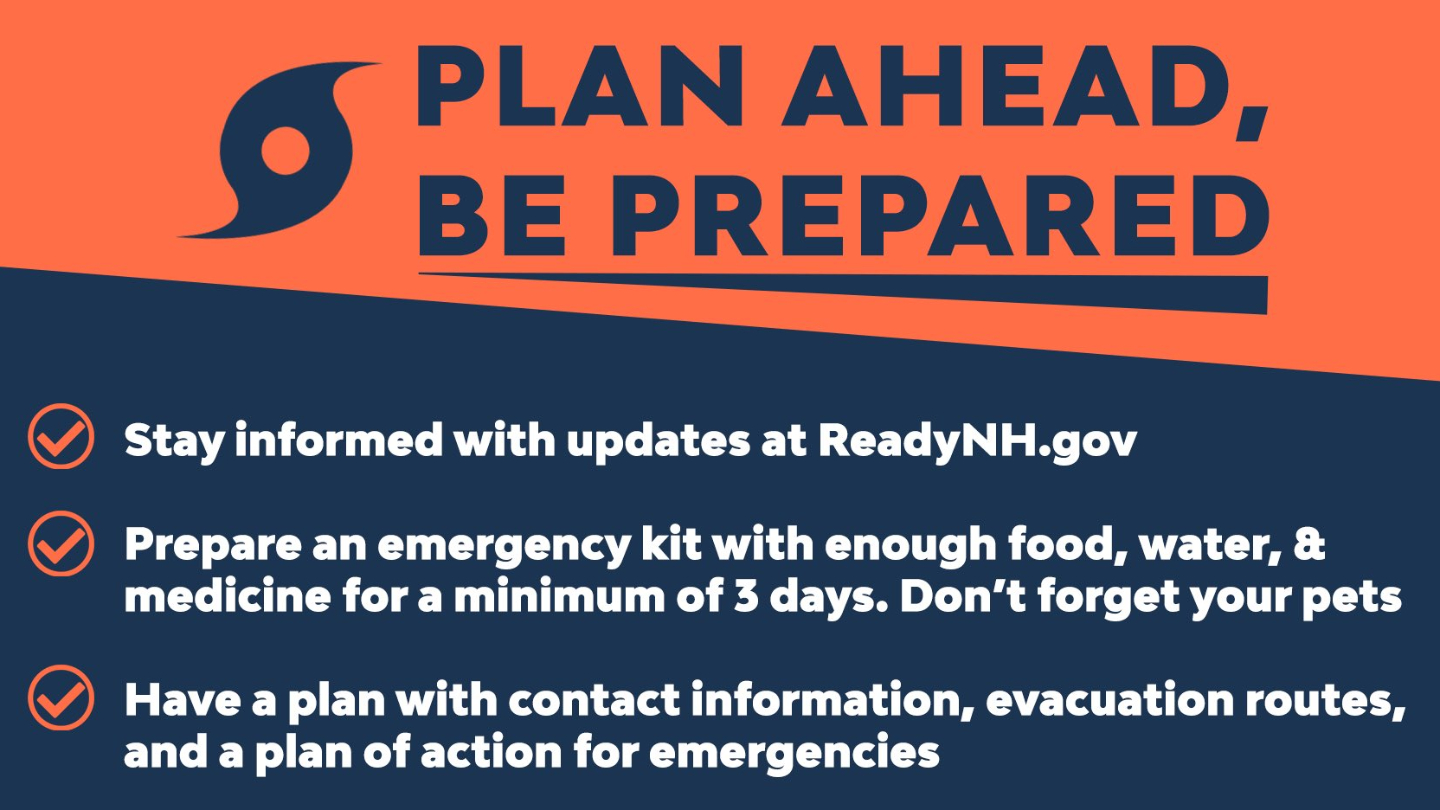

Limited NHFUK we or our trades meat cuts largely on behalf of its ultimate parent company NH Foods Limited NHFJP which is listed in Japan. A tax is imposed on taxable meals based upon the charge therefor as follows.

Dining Nh Collection Mexico City Centro Historico

The state meals and rooms tax is dropping from 9 to 85.

. A 9 tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants on rooms and meals costing 36 or more. We pay 9 percent which goes into state coffers well most of it. These excises include a 9 tax on.

The cost of a New Hampshire Meals Tax Restaurant Tax depends on a companys industry geographic service regions and possibly other factors. The New Hampshire Senate recently passed a bill SB 404 which would phase out the state tax on. File and pay your Meals Rentals Tax online at GRANITE TAX CONNECT Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85 For.

A 9 tax is also assessed on motor. New Hampshire does tax income from interest and dividends however. What is the tax rate for prepared food in NH.

A tax of 85 percent of the rent is imposed upon each occupancy. The Interest and Dividends Tax is a flat rate of 5. Prepared food is subject to special sales tax rates under new hampshire law.

78-A6 Imposition of Tax. New Hampshires meals and rooms tax is a 85 tax on room rentals and prepared meals. Want this question answered.

Be notified when an. New hampshires meals and rooms tax is a 85 tax on room rentals and prepared meals. A 9 tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants on rooms and meals costing 36 or more.

New Hampshires meals and rooms tax is a 85 tax on room rentals and prepared meals. A New Hampshire FoodBeverage Tax can only be obtained through an authorized government agency. Prepared food is subject to special sales tax rates under new hampshire law.

Meals paid for with food stampscoupons. New hampshire does not have any state income tax on wages. At LicenseSuite we offer affordable.

So the tax year 2022 will start from july 01 2021 to june 30 2022. North Dakota Nearly all sales of prepared food or meals by hotels restaurants convenience stores delicatessens concession stands coffee shops other eating places and. Depending on the type of business where youre doing business and other specific.

A 9 tax is also assessed on motor vehicle rentals. Advertisement Its a change that was proposed by Gov. The tax must be separately stated and separately charged on all invoices bills displays or contracts.

Sales Tax Create. Chris Sununu in this years budget package which passed. A tax of 85 percent of the rent is imposed upon each occupancy.

The exemption for that tax is 2400 for single filers and.

Concord Nh Restaurant Book Your Event With Us Cheers Grill

Nh Dept Of Revenue Completes Project To Expand Online Tax Services Necn

Five Prix Fixe Restaurants In New Hampshire

Thanksgiving Concord Food Co Op

99 Restaurants Home Londonderry New Hampshire Menu Prices Restaurant Reviews Facebook

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Muse Thai Bistro Menu In Manchester New Hampshire Usa

Everything You Need To Know About Restaurant Taxes

Amazon Com Rosina Italian Style Meatball 52 Ounce 8 Per Case Grocery Gourmet Food

Tamarack Restaurant Laconia Menu Prices Restaurant Reviews Tripadvisor

Sales Taxes In The United States Wikipedia

Oak Grain New London Nh Dining Inn At Pleasant Lake

How Are Groceries Candy And Soda Taxed In Your State

:max_bytes(150000):strip_icc()/best-and-worst-states-for-sales-taxes-3193296_final_CORRECTED-4d56f8efcd264f53981a40415c0e6de3.png)

The Best And Worst States For Sales Taxes

Meals And Rooms Tax Nh Issue Brief Citizens Count

Nh Collection Mexico City Santa Fe 4 Hotel In Mexico City

New Hampshire Sales Tax Handbook 2022

New Hampshire Sales Tax Rate 2022

Best Mexican North Of The Massachusetts Border The Boston Globe